Ag Marketing IQ: History shows the average rally in each year of the past decade was 51 cents!

Expected record U.S. corn yield, modest export demand, and a stubbornly large 2-billion-bushel carryout projected for the 2024-25 crop year continues to weigh on corn prices.

Will there ever be a price rebound? When will the bleeding stop?

What’s happened

December 2024 corn futures prices have been sliding lower since mid-May, recording a $1 price loss. The notion that nationwide corn yield will be massive, with the USDA pegging yield at 183.1 bushels per acre on the most recent WASDE report, is the largest anchor on prices. Not helping is a U.S. corn export pace compared to years past that’s modest when compared to years past. Competition from South America also pressures prices.

With this $1 price drop, many producers are asking if there will be any price rebound in the coming weeks. Good news. From a historical perspective, the answer is likely yes.

From a marketing perspective

Seasonally, December corn futures tend to find a price low sometime in September.

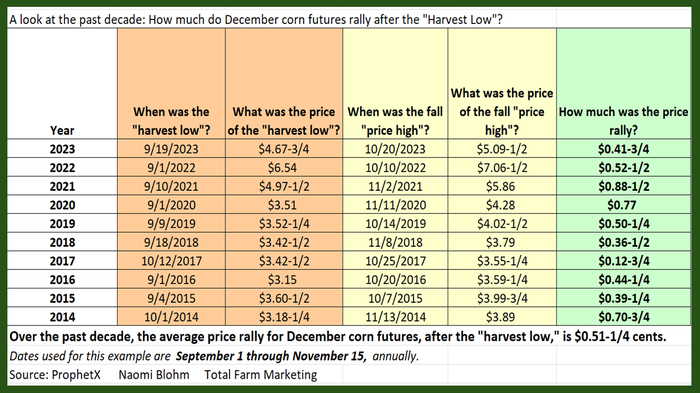

Keep in mind, past performance is not indicative of future results. Yet looking at the past decade, in 8 out of 10 years, December corn futures found a “harvest low” in September and then rallied. When looking at the time frame from Sept. 1 until Nov. 15, the average rally for December corn futures over the past decade was just over 51 cents!

A few notes about this chart that I created. For the purpose of this article, I used the dates of Sept. 1 through Nov.15, annually, to quantify the “harvest low” and potential rally time frame. (While the December corn futures contract does indeed trade past Nov. 15, I chose to exclude price values past Nov. 15, as the contract gets near the first-notice-day time frame for contract expiration.)

Also note that in some of the years in the past decade, December corn futures prices did not trade straight up after the “harvest low,” but instead zigged and zagged on the way up.

Prepare yourself

Why would the corn market potentially rally you ask?

-

Much of the negative fundamental news may already be priced in.

-

To show third-quarter profits on the books, managed money fund traders, who hold a hefty net short position of 257,896 contracts of corn, may exit (buy back) some of those short positions in September.

-

With corn prices historically cheap, now under the $4.00-mark, End users may be quite excited to step up and secure supplies based on historical value.

-

Given the geo-political arena continues to be a global circus show of uncertainty, some corn importing nations may book now to ensure food security through the winter. Potential weather woes also play into this. What if the weather in Brazil is horrible in December and January, and their crops are stressed?

History suggests a potential harvest low and rally may be just around the corner. It is important to be aware and watch for a potential “harvest low” on daily or weekly technical charts.

Any type of price rally into year-end would be welcomed by many producers as they begin to harvest corn in the field. Be ready to act on it.

Reach Naomi Blohm at 800-334-9779, on X (previously Twitter): @naomiblohm, and at naomi@totalfarmmarketing.com.

Source: https://www.farmprogress.com/commentary/will-we-see-a-price-rebound-in-corn-