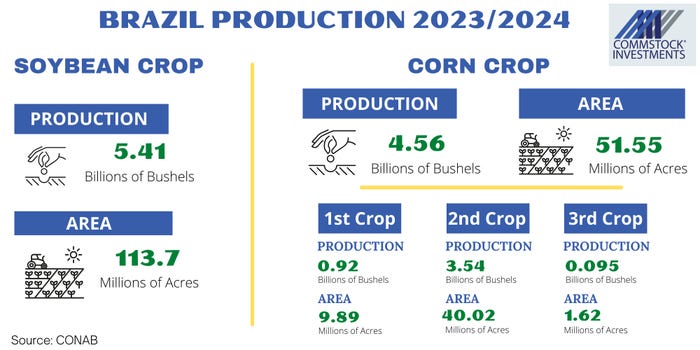

Ag Marketing IQ: CONAB’s report nets nearly zero change for the 2023-24 soybean crop but shipping indicators suggest Brazil’s corn exports are down.

CONAB’s July update left Brazil’s 2023-24 soybean crop estimate virtually unchanged. Digging deeper, the numbers show total production acres increased but were offset by modest reductions to yield.

Soybean acres were set at 113.7 million compared to the U.S. 2024-25 acreage at 86.1 million. Brazil’s start to their planting season is still two months away, but we already have seen private estimates putting planted area at 117 million for their upcoming crop. This would be a 2.9% boost over last season’s production area and could potentially put Brazil soybean crop at 170 MMT.

While everyone seems to agree that land area growth in Brazil will be more modest going forward due to plunging commodity prices, the market will debate for some time by how much. Since the year 2000, year-over-year growth for the Brazil soybean area has averaged 5.4%.

Production area rarely drops. The last drop was in the 2006-07 season, when acreage fell 9.1% from the prior year. That year, soybean prices fell from a high of $10.50 per bushel the year prior to $5.50.

We see a more modest increase in Brazil’s soybean acres, up from 1% to 2%. However, we would point out that 2% still amounts to a significant increase, about 2.2 million acres. Remember that increase is on top of twice as many acres as 20 years ago.

Brazil’s corn crop: 115.8 MMT

Most of the focus in the CONAB report fell on the corn production estimates as the harvest of the second crop of corn is on the home stretch and well ahead of schedule.

CONAB boosted Brazil’s total corn crop to 115.8 MMT. The report slightly reduced first crop estimates due to modest changes to acres and yield. But that was more than offset by an increase in both acres and yield in the second crop, taking their estimates to just over 90 MMT. A 6 MMT gap in production estimates still separates USDA and CONAB. It increasingly appears that gap won’t close – at least not completely.

Brazil corn FOB basis remains relatively strong despite the ongoing harvest. Last year at this time Brazil FOB prices traded $0.30 below September compared to nearly $1 today. This would indicate corn volumes are lower than expected and USDA may need to lower Brazil’s corn export forecasts.

U.S. corn FOB is competitively priced at $0.15 below that of Brazil at roughly $4.75. This should help keep U.S. corn exports stay strong going into Brazil’s peak export season.

Source: https://www.farmprogress.com/commentary/less-corn-from-brazil-