Ag Marketing IQ: Full bins and strong yield expectations continue to weaken basis and drive down grain prices as harvest nears.

If what we are hearing from end users is correct, grain producers have had a challenging summer marketing both corn and soybeans and, unfortunately, are sitting on too much of last year’s crop.

It is estimated that 20% of the previous year’s corn crop, or 2.6 billion bushels, has not been sold as of July 12. At the same time, they continued to hold 15% of last year’s soybean crop (624 million bushels). These unsold bushels will likely keep a lid on “old crop” rallies as time is running out to get these bushels moved before the new crop harvest begins.

The cash market for both commodities continues to weaken as end users are getting to the point that they do not have to buy any more bushels to get them to the new crop harvest, resulting in weakening basis bids on top of weakening board prices. We recommend that if you are one of these producers in this position, you get aggressive, get the bushels sold, and prepare for the upcoming harvest.

Unfortunately, new crop marketing of corn and soybean crops is not much better. It is estimated that only 8% of the anticipated new crop soybeans has been marketed. New crop corn sales are only slightly better, with 10% of the expected crop marketed.

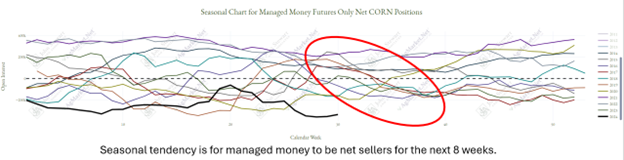

The trade goes long on corn

As of the third week of July, the commercial trader was long a net corn position, which is pretty much unheard of for this time of year.

The commercial has shown a net long position in only 12 reporting weeks dating back to 2006. In the past two weeks, the CFTC report has shown them carrying a net long for the first time since February – before that, the only net long was June 2020.

The managed money position continues to carry a massive short position. But it’s lighter than the record short they had been carrying.

Even with the price weakness evident since Memorial Day weekend, we expect continued downward pricing pressure, and producers should consider ways to mitigate the risk.

Expected yield may go up

The August WASDE report will be released in a little over a week. With the crop ratings where they currently are, the odds seem high that we will see an increase in the national trend yield for both corn and soybeans. Lowering the harvest area could offset some of the yield increase, but likely not enough to offset an increase in ending stocks.

The national corn crop ratings improved by 1% to 68% good-to-excellent the week of July 29. Overall, the rating remains the highest since 2020.

-

With this high rating, many in the trade think the overall U.S. yield could top out at 183.5 BPA versus the July USDA forecast of 181 BPA.

-

If the yield is revised as anticipated, it will break recent history, as USDA has lowered its average corn yield in the August production report for the last three years.

Soybean crop conditions this past week came in with 67% rated good-to-excellent, which remains the highest since 2020. Current ratings suggest an average yield of 53.5 BPA versus the July USDA forecast of 52 BPA.

If you have questions or would like specific recommendations for your operations and how to manage pricing risk for both old and new crop bushels into the fall, don’t hesitate to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

Source: https://www.farmprogress.com/commentary/it-s-time-to-aggressively-sell-corn